Today marks the return of guest blogger Dave Scully with Evolve Bank & Trust. Dave has over 20 years as a mortgage professional in the West Chester, Liberty Township, Mason and Greater Cincinnati marketplace.

Big Changes Coming to FHA Loans Effective April 4th! by Dave Scully, Guest Blogger on RealEstate-Ink.com

All FHA 30 year loans that are assigned case numbers on or after April 11, 2011 will have an increase in the Monthly Mortgage Insurance Premium (MIP) from .90bps to 1.15bps for loans with less than 5% down. For FHA 30 Year loans with greater than 5% down the Monthly Mortgage Insurance Premium will increase from .95 to 1.10BPS. (BPS=Basis Points) What is a basis point?

On a loan sales price of $163,000 this will increase the Monthly Mortgage Insurance Premium by $33. The net effect will be as if the rate is .375%-to a .50% higher in payment.

As if this wasn’t enough, effective on all FHA loans assigned case numbers after April 18th, 2001 the Up Front Mortgage Insurance Premium (MIP) on ALL FHA loans will increase from 1% to 1.25%. This amount is always financed.

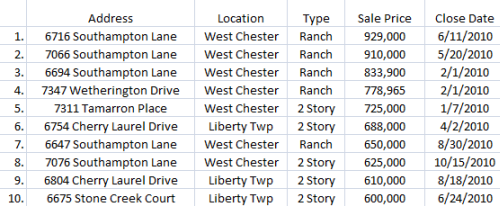

The best way to avoid the higher Mortgage Insurance Premium rates is to get out there and buy your home now! Rates are still at near historical all time lows! There are many great deals on homes out there!

SEARCH WEST CHESTER & LIBERTY TOWNSHIP OHIO HOMES FOR SALE HERE!

Go out and take advantage of all 3: (1) LOW RATES, (2) LOW HOUSING PRICES, (3) LOWER MORTGAGE INSURANCE PREMIUMS!