Butler County Ohio Property Tax Values

You haven’t seen your Butler County Ohio property tax bill yet for 2012, but when you do, the total value of your property will likely have changed. This property tax bill, commonly called the “January Bill” will reflect new property values for tax purposes.

You haven’t seen your Butler County Ohio property tax bill yet for 2012, but when you do, the total value of your property will likely have changed. This property tax bill, commonly called the “January Bill” will reflect new property values for tax purposes.

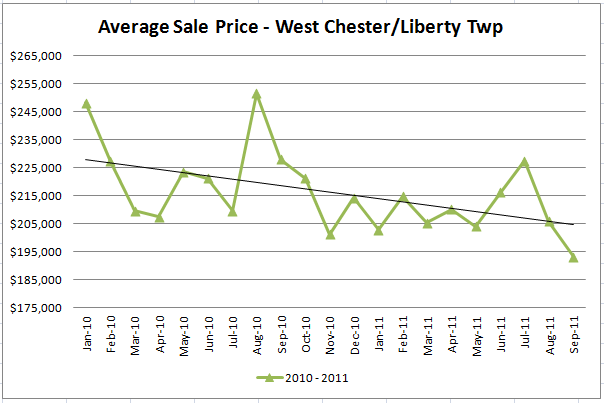

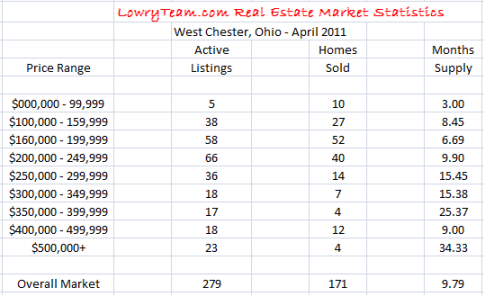

So, if your tax value is changing, does that mean that the values are going down? The real estate market has gone down, right? The truth is, your property value may go up or down (or even stay the same) depending on a number of factors including but not limited to a recent sale of the property and certainly depending on what the assessed tax value was previously.

Did you know that you can appeal the value that is established by Butler County for your property tax bill? The deadline to file such appeal is March 31, 2012. Why would you appeal this assessed property value? I’ll answer that in my next blog post, so be sure to check back.

Interested in seeing what homes in your neighborhood are selling for? Visit our website: www.HomeValuesInCincy.com for your very own real estate market update – It’s Automated and It’s Free!

Do you have questions about your property value that we can help answer. Fill out the form below and we will get back to you as quickly as we can.