How Home Ownership Impacts Your Net Worth

If you were to ask people what they think home ownership means, you’re likely to get all sorts of answers, ranging from security, family, sense of community, or wealth. However, in recent years, due to the economic conditions, many Americans have begun to question whether home ownership really is a good investment towards building wealth.

If you were to ask people what they think home ownership means, you’re likely to get all sorts of answers, ranging from security, family, sense of community, or wealth. However, in recent years, due to the economic conditions, many Americans have begun to question whether home ownership really is a good investment towards building wealth.

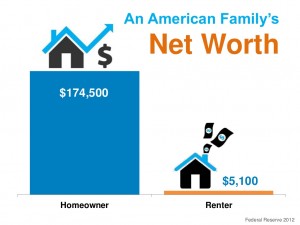

In order to address this concern, the Federal Reserve has recently conducted a study on homeowners and net worth. They found that the average American family’s net worth is $77,300. Of that net worth, 61.4% of it is in home equity. That’s $47,500!

Compared to renters, a homeowner’s net worth is over 30x higher. If that doesn’t speak to you just yet, consider this: The average homeowner has a net worth of $174,500 while the average renter has a net worth of just $5,100. This is because the monthly payments homeowners make on their mortgages go towards building equity. When you rent, you’re just throwing your money away. Your rent does nothing for you, whereas a mortgage payment will help you significantly build wealth.

The bottom line is that buying a home is still a sound investment and a great way to build wealth. It’s probably the only investment that you will make that, in addition to building your wealth, will also provide shelter and higher quality of life for you and your family. Start building your wealth now – buy a home.

Other articles that may interest you:

First Time Homebuyer Series: 3 Steps To Getting Started

First Time Homebuyer Series: Can You Afford To Keep Renting?

Low Interest Rates Aren’t Expected To Last – Now Is The Time To Buy A Home