West Chester & Mason Ohio Homebuyers To Face Higher FHA Mortgage Insurance Costs

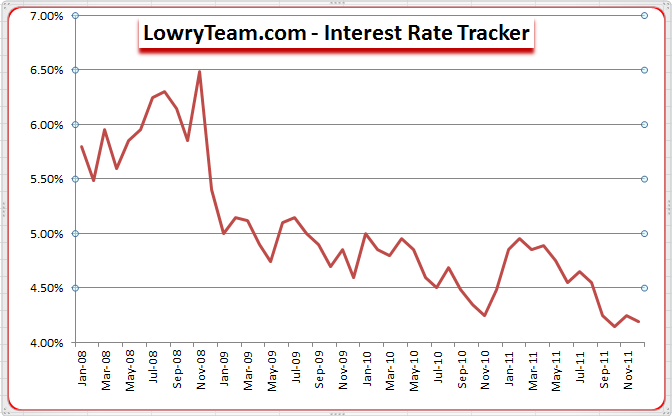

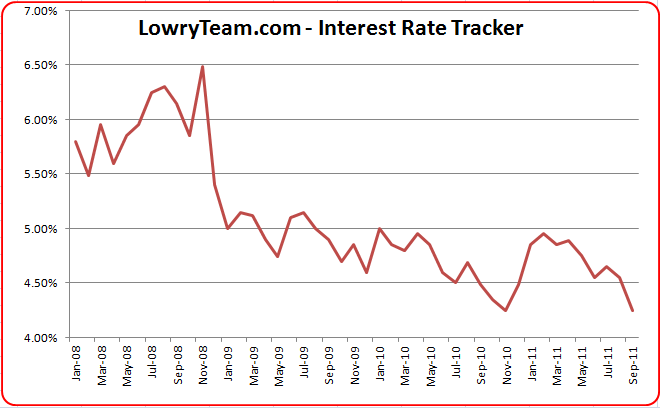

Homebuying is about to get quite a bit more expensive for many home buyers in West Chester & Mason Ohio, not just first time homebuyers. No, interest rates are not on the rise (yet). It’s the cost of mortgage insurance that is going up. The Federal Housing Administration (FHA) which backs mortgages that allow for smaller down payments has announced that it is increasing the cost on two types of fees that homebuyers must pay.

Homebuying is about to get quite a bit more expensive for many home buyers in West Chester & Mason Ohio, not just first time homebuyers. No, interest rates are not on the rise (yet). It’s the cost of mortgage insurance that is going up. The Federal Housing Administration (FHA) which backs mortgages that allow for smaller down payments has announced that it is increasing the cost on two types of fees that homebuyers must pay.

The increase in the mortgage insurance costs is two fold for FHA backed mortgages. (1) the FHA has announced that it will increase it’s annual mortgage insurance premium by .10 of a percentage point for loans under $625,000, which will now cost 1.25% of the loan amount. This increase takes effect on April 1st. (2) the second fee being raised is the upfront mortgage premium. It is being raised by .75 of a percentage point, making the premium 1.75% of the loan amount. This fee is often rolled into the mortgage.

Moral of the story… you may want to get a home under contract to purchase and a mortgage loan application submitted before April 1st if you would like to avoid these higher costs of obtaining a mortgage. All of this assumes of course that you are obtaining an FHA backed mortgage. If you are using a conventional mortgage to buy a home this increase does not effect you.