|

|

Are you considering selling your home? Did you have it listed but it didn’t sell? Your home may need a bit of work before it will sell at the best possible price. Here are some easy home improvements you can make to increase home value and improve your chances of selling quicker.

Are you considering selling your home? Did you have it listed but it didn’t sell? Your home may need a bit of work before it will sell at the best possible price. Here are some easy home improvements you can make to increase home value and improve your chances of selling quicker.

Step up your curb appeal – First impressions are everything, and the front of your home is what buyers see first. You can easily step up your curb appeal and increase home value by mowing and edging the grass, trimming shrubs, and planting flowers. If the paint on your front door or garage door has seen better days, repaint them. Consider replacing the shabby mailbox, adding new house numbers, power-washing the driveway (and the house if it has vinyl siding) etc. A well-kept front yard makes buyers much more willing to come inside for a look.

Upgrade kitchen appliances – The kitchen is one of the best places to see return on your investment in home improvements. If you are not looking to do a full kitchen update, simply upgrading your kitchen appliances will make a huge difference to how potential buyers see your home. If you want to go a step further, you can update the hardware on the cabinets, or even give the cabinets a new finish. Improving the kitchen is a great place to start when you want to increase home value.

Paint neutral tones – Have deep red walls that you just love? Go to your nearest home improvement store and buy some neutral paint tones such as cream, taupe, etc. Neutral paint tones tend to make rooms look bigger and more open. Buyers see dark or wild paint colors as more work and money to change. A fresh coat of neutral paint is an easy and cheap improvement, but will make a significant difference.

Take a look at your flooring – Are your carpets looking a little rough? Get them professionally cleaned. Do you have any dated vinyl flooring? Consider replacing it with neutral laminate or tile. Making your home look clean and updated is a quick way to impress buyers and increase home value.

Don’t forget the basics – Buyers expect the basics of the home to be in good, working order, so make sure you address any issues beforehand. If your roof is old or leaking, it should be replaced or fixed. Address any problems with heating and air-conditioning units or plumbing. Making sure the basics work can definitely increase home value. You don’t want to lose a sale to competition or reduce your home value just because one of these things aren’t up to par.

Other articles that may interest you:

If you were to ask people what they think home ownership means, you’re likely to get all sorts of answers, ranging from security, family, sense of community, or wealth. However, in recent years, due to the economic conditions, many Americans have begun to question whether home ownership really is a good investment towards building wealth.

If you were to ask people what they think home ownership means, you’re likely to get all sorts of answers, ranging from security, family, sense of community, or wealth. However, in recent years, due to the economic conditions, many Americans have begun to question whether home ownership really is a good investment towards building wealth.

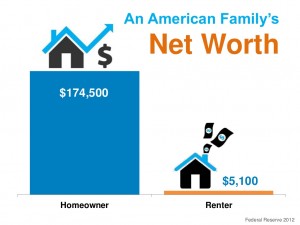

In order to address this concern, the Federal Reserve has recently conducted a study on homeowners and net worth. They found that the average American family’s net worth is $77,300. Of that net worth, 61.4% of it is in home equity. That’s $47,500!

Compared to renters, a homeowner’s net worth is over 30x higher. If that doesn’t speak to you just yet, consider this: The average homeowner has a net worth of $174,500 while the average renter has a net worth of just $5,100. This is because the monthly payments homeowners make on their mortgages go towards building equity. When you rent, you’re just throwing your money away. Your rent does nothing for you, whereas a mortgage payment will help you significantly build wealth.

The bottom line is that buying a home is still a sound investment and a great way to build wealth. It’s probably the only investment that you will make that, in addition to building your wealth, will also provide shelter and higher quality of life for you and your family. Start building your wealth now – buy a home.

Other articles that may interest you:

First Time Homebuyer Series: 3 Steps To Getting Started

First Time Homebuyer Series: Can You Afford To Keep Renting?

Low Interest Rates Aren’t Expected To Last – Now Is The Time To Buy A Home

|

Many potential homebuyers may assume that the holidays are not a good time to buy a home. This is a common misconception. There are numerous reasons that buying a home during the holidays can be a good choice. Serious buyers would be wise to consider taking advantage of the unique market conditions that occur during the holiday season. Here are some reasons buying a home during the holidays can be beneficial to you.

Many potential homebuyers may assume that the holidays are not a good time to buy a home. This is a common misconception. There are numerous reasons that buying a home during the holidays can be a good choice. Serious buyers would be wise to consider taking advantage of the unique market conditions that occur during the holiday season. Here are some reasons buying a home during the holidays can be beneficial to you.

Motivated Sellers – Those who choose to list their home for sale during the holidays are often under pressure to sell. Since these sellers can be so highly motivated, they are more likely to cut you a great deal.

Less competition – Since many homebuyers do choose to wait out the holiday season, this means less competition from other buyers. Lower competition with other buyers may mean you’ll be able to negotiate a better price for a home you want to purchase.

Better Interest Rates – Interest rates drop every December through January on a cyclical basis. In addition to that, due to the current market conditions with the Federal Reserve planning to taper bond purchasing, real estate and mortgage experts expect interest rates to begin a continuous rise beginning after the holidays. The Lowry Team’s preferred partner, Justin Phillips at Rapid Mortgage can work with you to meet your financial needs for buying a home during the holidays.

Tax Deduction – Buying a home and closing on it by the New Year can mean a significant tax deduction for you. All the mortgage interest you will be paying monthly is fully tax deductible. Property taxes will also be an annual deduction as long as you own your home.

Faster Closings – Closings are historically shown to be faster during the months of November and December due to the fact that the number of transactions occurring during these months is lower. The Lowry Team has a Transaction Coordinator that makes sure the process from contract to closing goes as smoothly and as quickly as possible for you as a buyer.

Other articles that may interest you:

Low Interest Rates Aren’t Expected To Last – Now Is The Time To Buy A Home

First Time Homebuyer Series: 3 Steps To Getting Started

First Time Homebuyer Series: Can You Afford To Keep Renting?

The real estate market is currently experiencing a huge window of opportunity for homebuyers. The Federal Reserve has been buying $85 million worth of bonds monthly. This has allowed the interest rates on mortgages to drop low in the first half of the year. Over the summer, we saw a steady increase in interest rates. This was due to a rumor that the Fed was going to stop buying bonds. Recently, however, the Fed has announced that they plan to continue to purchase bonds. What does that mean for you as a homebuyer? Well, it means that as of the announcement, interest rates are experiencing a temporary drop. This drop in interest rates greatly affects your purchasing power. These low interest rates could mean the difference between you buying your dream home or settling for your second choice.

The real estate market is currently experiencing a huge window of opportunity for homebuyers. The Federal Reserve has been buying $85 million worth of bonds monthly. This has allowed the interest rates on mortgages to drop low in the first half of the year. Over the summer, we saw a steady increase in interest rates. This was due to a rumor that the Fed was going to stop buying bonds. Recently, however, the Fed has announced that they plan to continue to purchase bonds. What does that mean for you as a homebuyer? Well, it means that as of the announcement, interest rates are experiencing a temporary drop. This drop in interest rates greatly affects your purchasing power. These low interest rates could mean the difference between you buying your dream home or settling for your second choice.

However, it is expected that the Fed is going to begin to taper their bond purchasing in December. Ben Bernake, Chairman of the Federal Reserve, states “If the data confirms our basic outlook, then we could move later this year.” This taper in bond purchases will drive interest rates back up. The National Association of Realtors, the Mortgage Bankers Association, Fannie Mae, and Freddie Mac all predict around a 1% increase in interest rates by this time next year. So if you have been on the fence about buying a home, let this be the push you need. This is your window of opportunity – don’t waste it.

Other articles that may interest you:

First Time Homebuyer Series: Can You Afford To Keep Renting?